Debt finance

The objective of the Group’s capital management is to support business operations and to ensure competitive operating conditions with optimal capital structure, as well as to enable the implementation of the strategy. In addition to operative cash flows, the capital structure is managed by potential share issues, acquisition of treasury shares by increase or repayment of financial liabilities, possible conversions between equity and financial liabilities, as well as through operative decisions on investments and growth and potential disposals of assets in order to reduce liabilities. The development of the Group’s capital structure is monitored, amongst other things, with the following: change in net debt, ratio of net debt to operating margin, and the cash flow forecast. Terveystalo currently has no credit ranking.

Key figures

| Q3/2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Equity ratio, % | 39,6 | 39,4 | 36,5 | 40,2 | 42,2 | 42,1 | 39,9 |

| Net debt | 500,5 | 504,8 | 598,1 | 566,6 | 519,0 | 490,9 | 548,2 |

| Gearing, % | 89,1 | 92,1 | 116,0 | 95,7 | 85,2 | 85,9 | 101,3 |

| Net debt/adjusted EBITDA (last 12 months) | 2,0 | 2,1 | 3,0 | 3,2 | 2,5 | 3,0 | 3,1 |

| *) Adjustments are material items outside the ordinary course of business, associated with acquisition-related expenses, restructuring-related expenses, gain on sale of assets, impairment losses, and strategic projects and other items affecting comparability. | |||||||

Financial liabilities

| MEUR | 30 Sep 2025 | 30 June 2025 | 31 Dec 2024 | 31 Dec 2023 | 31 Dec 2022 | 31 Dec 2021 |

| Loans from financial institutions | 291,5 | 287,1 | 278,9 | 313,8 | 419,2 | 365,4 |

| Bonds | 99,5 | 99,4 | 99,3 | 99,1 | - | - |

| Hire purchase liabilities | - | - | 0,0 | 3,8 | 8,0 | 13,3 |

| Lease liabilities | 188,9 | 184,5 | 191,8 | 219,1 | 179,8 | 178,5 |

| Total | 579,9 | 571,0 | 570,0 | 635,7 | 607,0 | 557,2 |

The net debt includes interest bearing liabilities less interest bearing receivables and cash and cash equivalents. A significant part of the interest bearing liabilities consists of loans from financial institutions.

The Group’s loan agreements include a covenant, based on which creditors can demand an immediate repayment of the loans if a certain covenant limit is breached. The covenant relates to the ratio between EBITDA and net debt. The Group has met all covenant terms and conditions during the reporting period and at the reporting date.

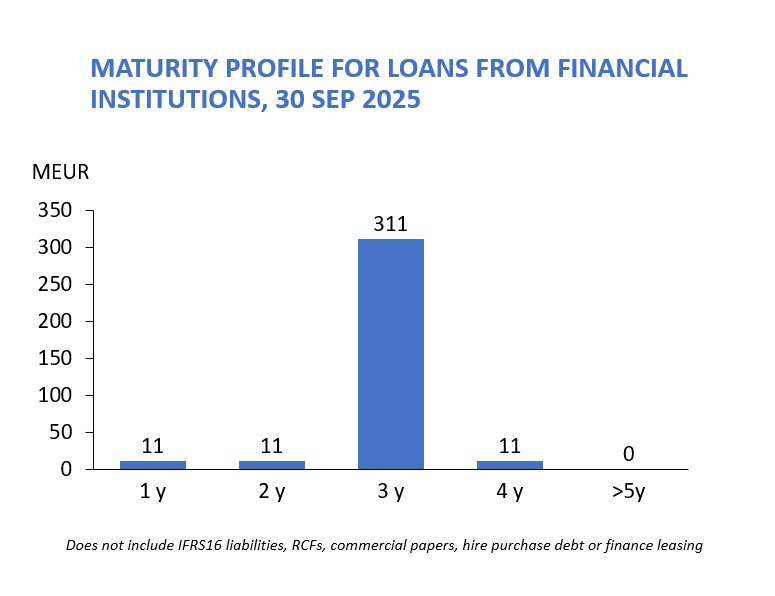

Maturity profile

. The average maturity of Terveystalo's financial loans was 2.3 (2.4) years at the end of the reporting period, and in the third quarter of 2025, the average interest rate for loans from financial institutions was 3.6 (4.4) percent. During the reporting period, the company fulfilled the covenant requirement included in its financing agreements reflecting relative indebtedness.

Loan agreements

-

Q4 2024

During the reporting period, the company signed agreements for long-term loans of total EUR 200 million and refinanced the current revolving credit facility (RCF). The loans are bullet loans, and the maturity of the loans is three years supplemented by two one-year extension options. The loans were withdrawn fully and used to refinance bank loans maturing during 2025 and 2026. In connection with the refinancing, the company agreed on the refinancing of a EUR 80 million revolving credit facilities maturing in 2026 and 2027. The maturity of the syndicated credit revolving facility is three years supplemented by two one-year extension options.

-

Q4/2023

During the reporting period, the company signed an agreement for a long-term loan of EUR 135 million linked to sustainability targets and refinanced the current revolving credit facility. The loan is a bullet loan, and the maturity of the loan is three years supplemented by an extension option of one year. EUR 125 million of the loan was withdrawn and used to refinance bank loans maturing during 2023 and 2024. In connection with the refinancing, the company agreed on the refinancing of a EUR 40 million revolving credit facility maturing in 2024. The maturity of the syndicated credit revolving facility is three years supplemented by an extension option of one year.

-

Q3/2023

After the reporting period, in October, the company signed an agreement for a long-term loan of EUR 135 million and refinanced the current revolving credit facility. The loan is a bullet loan and the maturity of the loan is three years supplemented by an extension option of one year. The loan will be used for refinancing the loans due in 2023-2024. In connection with this, the company agreed on the refinancing of a EUR 40 million revolving credit facility due in 2024. The maturity of the credit revolving facility is three years supplemented by an extension option of one year.

-

Q3/2022

The company signed an agreement for a long-term loan of EUR 120 million. The loan is a bullet loan with a three-year maturity.

-

Q2/2022

The Nordic Investment Bank (NIB) and Terveystalo agreed on a long-term loan of EUR 50 million for financing the company's investments in its digital healthcare services and applications during 2022–2025. The company expanded the domestic commercial paper program to a EUR 200 million multi-bank program. Under the program, the company may issue commercial papers with a maturity of less than one year.

-

Q1/2022

The company signed an agreement for a EUR 100 million domestic commercial paper program and issued its first commercial papers under the program. The company also signed a financing agreement that includes a credit facility of EUR 40 million and an uncommitted credit facility of EUR 80 million.

-

Q4/2019

Terveystalo signed a facilities agreement of EUR 410 million (of which RFC 40 MEUR; Facility A 160 MEUR, a fixed amortization schelude; Facility B 210 MEUR, bullet), interest rate of which takes into account Terveystalo's achievement of its responsibility targets for improvement in customer satisfaction, employee satisfaction and well-being as well as mixed waste reduction. The maturity of the loan is five years.